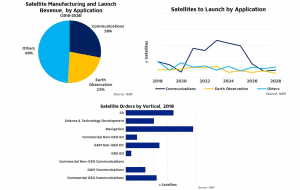

NSR's Satellite Manufacturing and Launch Services, 9th Edition report forecasts a $225 billion market opportunity over the next decade, driven by Situational Awareness and Earth Observation markets. Despite the hype created by smallsat LEO constellations, the traditional market is expected to remain the dominant source of revenue globally for building and launching satellites. While it is not likely to return to heady levels of yesterday, new opportunities are emerging that the industry can grasp if it adapts to a nimbler state of affairs.

NSR's Satellite Manufacturing and Launch Services, 9th Edition report forecasts a $225 billion market opportunity over the next decade, driven by Situational Awareness and Earth Observation markets. Despite the hype created by smallsat LEO constellations, the traditional market is expected to remain the dominant source of revenue globally for building and launching satellites. While it is not likely to return to heady levels of yesterday, new opportunities are emerging that the industry can grasp if it adapts to a nimbler state of affairs.

As the industry looks for a new normal, innovative trends are emerging, commented Shagun Sachdeva, NSR Senior Analyst and report co-author. With opportunity ranging from high capacity satellites to generic, flexible and small GEO satellites, demand remains varied and specific to operators and markets. While no one size fits all, hybrid architectures with fleets of different-sized assets and orbits will be a key feature of the next 10 years.

With declining capacity prices seen over the past years, business case viability remains a challenge for satellite operators in this uncertain environment. And this means orders are no longer the correct market indicator. Even if the industry might see an increase in manufacturing demand, the market size will experience an overall decline as efficiency-to-cost ratio per satellite increases.